How it works

Your PDF Document

Print, and Share

It Legally Binding

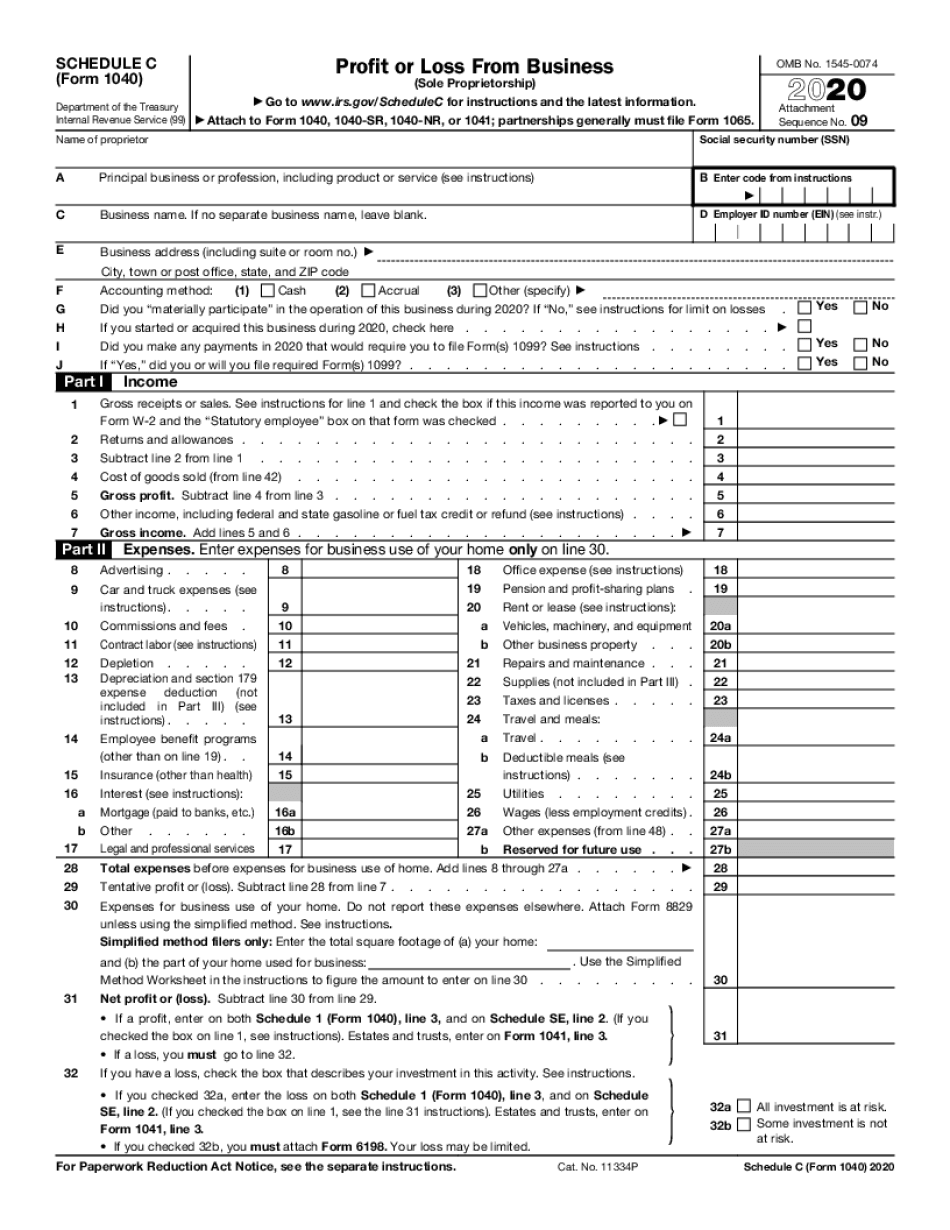

What is Schedule C 1040 Form?

Schedule C is part of Form 1040. It's used by sole proprietors to let the IRS know how much their business made or lost in the last year. The IRS uses the information in Schedule C to calculate how much taxable profit you made 14and assess any taxes or refunds owing.

How to Extract PDF Pages From Schedule C 1040 Form

Try out the fastest way to Extract PDF Pages From Schedule C 1040 Form without printing. Launch our web-based editor via any browser regardless of your device and operating system. The solution provides you with a full-featured toolkit to simplify and facilitate editing. Look at the step-by-step instructions below and find out how to take advantage of the features:

Feel confident when managing documents via our editor, knowing that the solution is GDPR- and ESIGN- compliant. Prepare your PDF in clicks, Extract PDF Pages From Schedule C 1040 Form, modify existing content, and add a new one to cope with red tape using a secure and reliable workflow.

Advantages to Extract PDF Pages From Schedule C 1040 Form here

Our solution helps you work with PDFs hassle-free. Explore the platform capabilities and benefits for a seamless workflow. Boost efficiency and Extract PDF Pages From Schedule C 1040 Form in clicks. Instead of working hard to fix documents, focus on your goals and instantly solve any PDF-related problem. Get rid of annoying bureaucracy and enjoy a robust document turnaround. Manage files, process data, and work from anywhere in the fastest and most straightforward way. Check out the other advantages and find out that the service brings you: